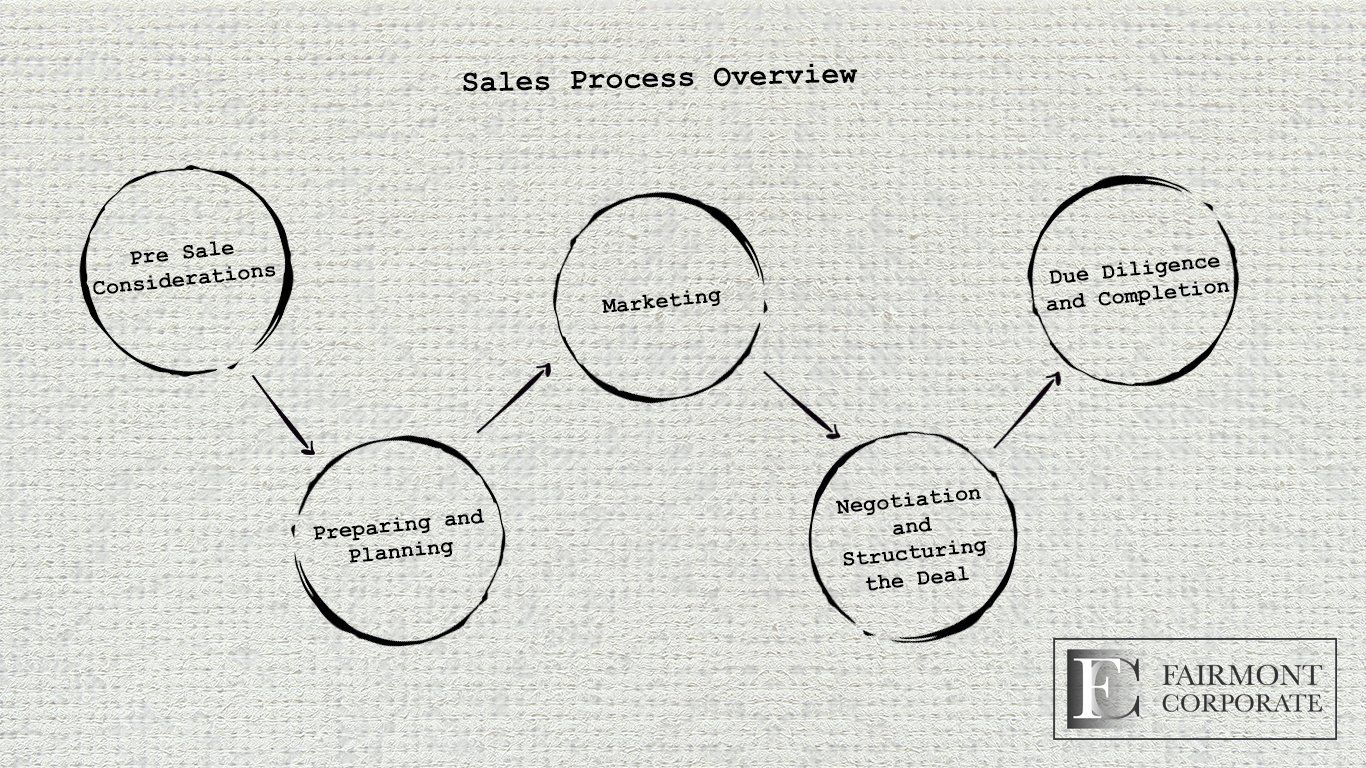

The sale process

The five stages of a deal.

This is an overview of how our processes are run from start to finish.

We recognise every company is unique, therefore every process is unique.

This should give you a general understanding.

Stage 1 Pre Sale Considerations

Before committing to sell your company, it is worth taking time to consider the implications. To support you with this, we offer a confidential, no obligation pre-sale meeting with one of our Directors. They will discuss the options available to you and present a clear understanding of what lies ahead. Their experience will often highlight options and solutions you may not currently be aware of, or have considered. This allows us to offer a bespoke service to our clients.

Stage 2 Preparing and Planning

We need to understand the opportunity we are representing. From meeting with one of our Directors and the completion of our Company Briefing Form, we will produce an Information Memorandum containing a detailed summary about the opportunity, including the current and future projected operating figures. We put ourselves in the eyes of an acquirer to highlight the reasons why they should invest. Alongside this, we will produce a ‘Teaser Document’, which includes salient points about your company and headline financials, but does not give the company name or specific identifiers.

Stage 3 Marketing

The old adage is very true, it’s not what you know but who you know. Possibly our greatest asset is our contacts within the industry. Over a number of years, we have built up an exceptional network of investors, organisations and high net worth individuals and have the internal ability to identify the type of company they are seeking to acquire.

In tandem with this, we offer the most comprehensive search for your perfect buyer. We explore every possible avenue through our meticulous research. Our rigorous search process will ensure we develop competitive interest that will play a major part in maximising your company’s value.

Stage 4 Negotiation and Structuring the Deal

This is a critical stage. We need to take the seller out of the equation as they have an emotional attachment to the company. By creating competitive tension by generating interest from multiple markets, this allows us to secure the best deal for our client.

As important as agreeing the price, is agreeing the structure. There are various ways the consideration can be paid, such as cash at completion, deferred payments, earn outs / true ups or shares. We at Fairmont Corporate use our expertise to structure the most suitable deal to suit our clients’ circumstances.

Stage 5 Due Diligence and Completion

Once the price and structure have been agreed, the Heads of Terms must be signed. In tandem with this, the legal firm representing our client will become involved. We work closely with international law firms. They will work alongside Fairmont organising the due diligence and helping with the buyer’s requirements. We will assist with all stages of Due Diligence including legal, commercial and financial.

When the buyer is comfortable with the diligence they have carried out, their solicitor will draw up the Sales Purchase Agreement (SPA), which is simply the contract.

The SPA is signed by both parties and with various other documentation to be signed, the sale will complete.

The above may seem daunting but remember we do this on a daily basis. We understand the potential pitfalls that can occur and are on hand to advise and assist both parties to successfully conclude a sale.

Arrange a free market appraisal for your company today...

Contact

Head Office Telephone0800 520 0498

Email

Head Office Address

Fairmont Corporate LtdDiscovery House, Crossley RoadStockport • SK4 5BH

© 2024

All Rights Reserved | Fairmont Corporate Ltd